Forge News and Updates |

Researchers say about 60 percent of people make New Year’s resolutions but only about 8 percent are successful in achieving them. We’re here to encourage you by saying this: you don’t have to make New Years resolutions that stress you out. What are you wishing for in 2020? Hear from the Forge community about the goals and resolutions they’ve set for this year.

“My 2020 resolution is to have better ‘digital hygiene’ – I want to get off of my phone and understand why I am picking up my phone each time. If it’s a meaningless pick up, then I don’t need to do it.”

Ryan

“My goal is to read 3 books every month. Each book will have a different topic: 1. Marketing 2. Self-Development 3. Entrepreneur Life”

Jacqui

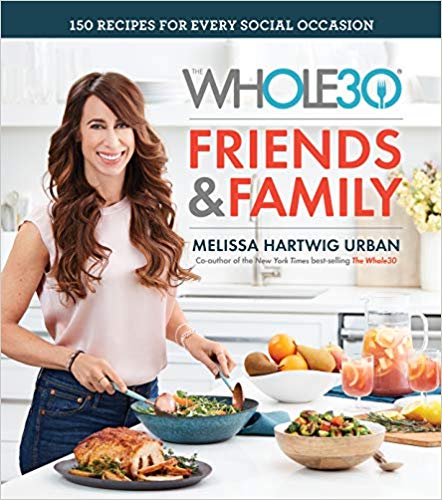

“I’m doing the Whole 30 diet in January. I hope it’ll help me be more conscious of what I’m eating and focus on reading every food label to see the ingredients.”

Beth

“My New Years resolution is to be able to touch my toes. So I’ll be stretching every day to try and improve my flexibility”

Matthew

“I’m planning to cook through a whole cookbook in 2020. I picked the new Defined Dish cookbook- it’s full of healthy, easy recipes. I love cooking but don’t always feel adventurous with meals cooked at home so I hope this will help me try new things!”

Kelsey

“My New Years resolution is more of a verb that I have for the year: ‘Execute.’ I want to carry out all my goals without finding a reason to wait. The time is now!”

Alex R

“I picked 5 easy things that I can execute every day of this year. One of them is to post from my business Facebook page every day in 2020.”

Stanley

“My goal is to read at least 12 books in 2020!”

Katelyn

“So, I don’t actually make New Year’s Resolutions because I think our culture sets us up for the wrong kinds of resolutions and also sets us up for failure. Instead of resolutions, I create annual goals as goals may not be achieved, but have measurable progress. For example, if my goal is to read 50 books in 2020 and I manage to get in 30, not only did I reach 3/5 of my goal, but I surpassed the 28 books I read in 2019. “

Rebecca

“One of my work-related goals is to loosen my grip on the outcome of work projects and instead focus on doing my best throughout the process, from beginning to finish.”

Kellyn

“I want to continue a healthier eating journey and enjoy the outdoors more.”

Alex G

Is one of your 2020 goals to be more productive in your business? Are you a remote worker? Entrepreneur? Well our most recent member survey showed that 90 percent of Forge members have increased their productivity since joining our coworking space. If you’re interested in trying out Forge, click here to schedule your tour!

Forge News and Updates |

Looking for a place to meet in Birmingham? Move your team to a conference room for your next off-site meeting. A change of scenery could help generate your next big idea. Maybe you need space for a board of directors or meet up group- look at this list we’ve compiled! Check out our list of the best conference rooms in Birmingham (in no specific order)!

Forge

Sitting at the heart of downtown Birmingham, Forge offers three beautifully designed conference rooms available for both members and visitors. At Forge, you have options of a smaller 4-person meeting room, a corner conference room, or a rooftop Penthouse conference room. Forge’s rooms have lots of natural light, audio and visual capabilities, and great views overlooking the Birmingham skyline. Book your meeting room today!

Forge Birmingham Conference Room

Forge’s soundproofed Podcast Room

Social Venture

Located in Woodlawn, Social Venture has four conference rooms available. Anyone can rent for 4-hour blocks or an all day rate. These four rooms can be broken down to fit smaller groups, or used to full capacity (holding up to 125 people!), perfect for workshops or training sessions for your team.

The Hub

The Hub is a collaborative coworking space located in Homewood. Whether you’re an entrepreneur eager to take your start-up to the next level, an established company seeking a vibrant work space for your remote employees, The Hub could be the perfect spot for you. They has meeting space for up to 15 people. The room is complete with a 40” HDMI Chromecast enabled screen, WIFI, lounge, greenspace and Seeds Coffee available upon request.

Birmingham Museum of Art

Looking to meet in a space with lots of culture, years of history, and a great location? The Birmingham Museum of Art has two meeting spaces available in 4-hour blocks. The museum has one boardroom style room and another meeting room that can be configured to fit many different layouts. The smallest of the two can hold up to 12 people, and the larger can fit up to 45.

With AV capabilities and lots of great spaces to take a break, the Birmingham Museum of Art is a great place to hold your business meetings.

Grand Bohemian Hotel Mountain Brook

Located in the heart of Mountain Brook, this beautiful 5-star hotel offers more than just a place to stay. The 400-person ballroom can be split up into three sections, each holding around 100 people. On the second floor, smaller rooms of 10, 20, and 30-35 people are available for anyone to rent. Call ahead to customize and book your space.

Worx BHM

Worx BHM is a sophisticated community with luxury private office suites and coworking space. With two different locations, they have great options for your group! One location is right off Lakeshore Blvd and the other is off Columbiana. Worx has two conference rooms available to book- one holds 16-20 and the other holds 12-16! People can email info@worxbhm.com or call 205-379-6023 to reserve a time slot.

Elyton Hotel

Located all the way up on the 16th floor, three rooms can be used separately or joined to form one larger meeting room. 1500 square feet make up the Empire room, made to hold up to 125 guests. This room can be split up and configured to accommodate smaller groups. A smaller pre-function area makes this space perfect for larger events and receptions.

If you’re looking for a spot to hold bigger board meetings, the Forge room is the perfect answer. Made to fit around 10-30 people, this room can be set up to fit any preference. Call ahead to reserve your room today! Check it out online here.

The Edge of Chaos

The Edge of Chaos is another great option for smaller groups. Right in downtown Birmingham, these two conference rooms are located in a perfect spot for business meetings. The smaller of the two is designed to seat 6, and the bigger can hold up to 12 people. With smartboard capabilities and affordable prices, The Edge of Chaos may be perfect for your business!

SaveSave

Forge News and Updates |

We make a big deal out of celebrating birthdays at our house. In our family, we celebrate not just the day but the whole month. During your birthday month you get a lot of very special privileges: sitting in the favorite seat at the dinner table, first to get dessert, random singing of happy birthday… We make an extra effort to make the birthday boy or girl feel loved and appreciated as we reflect on the very special role they play in our family. Birthdays always lead me to reflect on just how quickly times passes and that I am thankful for each and every day with my family.

As we come to the end of Forge’s birthday month, I have gone through a lot of the same reflections and thankfulness of this journey that we are on together. I underestimated both the difficulty of opening a business and growing it to a thriving community, as well as the joy it brings. I love seeing Forge filled with people who have a place that they are proud to work as they are drawn out of isolation at home and now have thriving businesses because they are surrounded by people who push themselves to grow. It is truly a privilege to serve so many amazing companies every day. I am humbled and thankful for the members of Forge who choose us as their place to work.

Over the past two years (and really the two years before that as I was building Forge) I have seen tremendous support from the Birmingham community. One of the magical things happening now in our Magic City is the championing of new businesses. At Forge, we love being a part of helping businesses start and grow. As a business owner I have also experienced the same support and encouragement from both our members and other business owners and leaders in Birmingham. We are part of an amazing business-building ecosystem that I do not take for granted!

I am also extremely grateful for the team at Forge who make the vision a reality. Over the past two years we have had one full time staff person (we all love Kelsey!), several part-time staff members, and four interns. Each and every team member tirelessly serves the members of Forge. Because I underestimated how much I needed to grow as leader before I opened Forge I am that much more thankful for the team that has walked this journey with me, patiently helped me become a better leader and ultimately made Forge a special place for our members.

Birthdays are special and they are worth celebrating. We are thankful to be celebrating with you!

Forge News and Updates |

We combined our 2nd Birthday with Member Appreciation Week! Without our loyal members there would be no anniversary to celebrate. Food, drink, champagne and massages were all involved in the celebration. We planned something special for each day of the week to show our members how much we care for them!

Magic Muffin has always been a Forge family favorite. Muffins, scones and fruit to get the week started right!

Wednesday: Massages from Adrian Ward of Relaxation Room

Free ten minute massages from Massage Therapist Adrian Ward for our members! Adrian visits Forge monthly and schedules massages for the Forge community. She is an amazing massage therapist and our members certainly love having her around!

Thursday: Cake + Champagne + Birthday Surprise

We surprised our members with Forge t-shirts for everyone!

Friday: Lunch Sponsored by Pies & Pints

Huge thanks to Pie & Pints for sponsoring a huge lunch for our members! Pizza and salad all around! It was a great time for members to relax and get connect with one another.

We take pride in the Forge community and want to share some of our favorite aspects of Forge with you:

OVER 130 FORGE MEMBERS IN OUR WORKSPACE

WE ARE A LOCAL COMPANY IN THE HEART OF DOWNTOWN

EDUCATIONAL AND NETWORKING EVENTS EACH MONTH (most of which are open to the public!)

CONFERENCE ROOMS THAT ARE OPEN TO THE PUBLIC

Do you work from a home office or coffee shops? Do you want to increase your productivity? If you’d like to schedule a tour of our space, email us at info@workatforge.com. We’d love to answer any of your questions about memberships or meeting spaces. Join the Forge community today!