Forge News and Updates |

At Forge, we know working from home is hard! At first, working from home may seem like a dream come true. But then the distractions of home bombard you- not to mention it’s lonely. That’s exactly why we’ve started Tuesday/Thursday Virtual Happy Hours for Forge members which you can see above! And it may start to feel like your work day never truly ends. With most Forge members now working from home during the pandemic, we asked for their advice on how to be most productive.

Matt’s Tip:

“Uhhh… DONT work from home. My productivity is near zero right now. So many distractions!”

We know a lot of you are forced to work at home right now because of COVID-19 – we just thought Matt’s immediate response was pretty funny! Now let’s get on to the real advice…

Donna’s Tips:

1) Security should be your first consideration. Make certain that you have secured your router with a password, keep your virus protect programs up-to-date. Do not work on an unsecure Wi-Fi network.

2) Carve out a dedicated workspace, preferably with a window and an ergonomic chair, at minimum.

3) Cloud storage for remotely accessing your files. Download the app versions of your productivity programs, which should include a document scanner.

4) Stay in face-to-face contact with customers using tools such as Zoom.

Alex’s Tips:

1. I’m sure this one has been said 100 times, but creating a routine is huge. My wife has created a daily schedule for the kids and I have my morning and evening routine too. Equally important to that routine is to be flexible if you have to stray from it. For example, I wake up with our toddler between 6:30-7 when he comes in our room, make him breakfast, get an Audible story going, eat my breakfast, shower, and get my day started by 9.

2. Determine the times you will be looking at your emails/computer and times you will not. After a certain time I will periodically see emails come across my phone, but I am not reading them or responding to them once I am spending 1-2 hours with the kids before they go to bed. Additionally, don’t let the chores that need to get done around the house distract you or cause you anxiety. When you get out of deep work to just quickly do some laundry you will find it hard to jump back into what you were working on.

3. Definitely have a separate “office” that is ideally not your couch and has most of the things you will need and is somewhat removed from kids/animals if they are going to be distracting.

4. Have your work playlist that works for you. Because I am a highly sensitive person, I find it very distracting to have background music where someone is singing/talking, so I generally have a jazz station as background music.

Autumn’s Tips:

Big things for me are to manage my expectations – this is not business as usual so have grace with myself and others. But also work can still get done – so do what works for you (setting goals, setting timers, keeping a to-do list)

- I moved my to do list to my kitchen chalkboard so that it follows me when I’m tempted by other things.

- Schedule more meetings and make more of an effort to call people because you can’t stumble upon anyone.

Jeff’s Tip:

The first thing that popped into my mind was having a headset for all the Zoom calls. On calls with people who aren’t used to doing videoconferences, I’m noticing that there’s a certain “etiquette” that “newbies” aren’t used to (muting when not talking being the main thing) and – using a headset (as opposed to computer’s built-in mic and speakers) helps with that.

Jami’s Tips:

- Try to give yourself specific ‘office hours’. It’s easy to keep the laptop open and find yourself working 18 hour days, putting you at risk for exhaustion and burnout. I like to use a pomodoro timer to help me focus on specific tasks and give myself enough brakes to remain mentally sharp

- Keep a sense of humor. Dogs are going to cry, kids are going to barge in, technology will be overwhelmed and break. Right now, we’re all in this together and laughing together is really critical to keeping us all sane

- Find ways to socialize and have fun with your teams. I’ve had a blast attending virtual happy hours where we play online games, I’ve hosted Netflix Parties where we all watch and chat through an episode of Tiger King (drinking is suggested!)–find ways to keep everyone connected and having fun. One of my favorite activities was asking everyone to go around and spend 20 seconds ‘selling’ everyone else on the call on why their drink was the best one.

- Set aside time each day to get away from technology. Whether you’re reading a book, taking a walk, journaling–screen fatigue is real

So what are your productivity recommendations when working from home? Comment and tell us!

Forge News and Updates |

We love having the whole Bham Now team coworking out of Forge! They wrote this story on the history of Bham Now and why they choose to office in our coworking space. Read on!

Even if you’re a longtime fan of Bham Now, we bet you don’t know the story behind the company, what we do, who we are and where we’re headed. I sat down with Cindy Martin, Bham Now’s Founder and President, to get the scoop. Yes, I work there, so I’ll tell you the real story. Read on for all the details.

1. How Bham Now came to be.

According to Cindy Martin (CM), “Bham Now is Birmingham’s modern media. Our mission is to help connect people in Birmingham and to help celebrate the city’s renaissance by reflecting all the positive energy that’s happening in the Greater Birmingham Area.”

Where’d you get the idea for Bham Now?

CM: We saw a need in the marketplace from two constituents.

One is the general populace—I was continually hearing people say “I don’t know what to do in Birmingham; I don’t know where to go to find out what’s happening in Bham.” There was really a desire to know “how do I get involved.”

On the business front, we saw a need for local businesses to share their messages using content (storytelling, video, behind the scenes tours) because that is how consumers respond today. But businesses don’t necessarily have the resources or acumen to create content in a way that resonates or know how to measure effectiveness.

So we pieced those two things together to create Bham Now.

Much of the team works out of Forge now, but how did you start?

CM: At the very beginning, we all worked out of our houses. It was a handful of interns from local colleges and me with some tech support from my husband.

Planning for Bham Now started 4 years ago.

I had lots of media and internet business experience over the past 25+ years, and had given a lot of thought to what would be the next big wave in digital media.

Bham Now: In case y’all didn’t know, Cindy was CEO of AL.com from its founding in 1997 to its merger with state newspapers in 2012.

CM: When I spoke with a few people whose business acumen I respect, their input was “you don’t need a business plan; just start doing it.” This was some of the best advice I got.

What made you choose to grow your team at Forge, and how has that shaped the business?

CM: Kim Lee was getting the Forge co-working space started about the same time as Bham Now. Our younger team members wanted a place to meet up and collaborate and Forge was the perfect solution!

It has offered Bham Now a beautiful, motivational and collaborative environment right in the middle of the downtown action. You can tell from all the pictures in this piece and from our Instagram how much fun the team has exploring all things Birmingham. Forge is the perfect launching pad for all that.

Since Bham Now has been growing so much, it has allowed our rent expense to grow as we add people which is a huge benefit for a start-up company.

You don’t always know what your needs will be 2 or 3 years down the road. Forge provides options so you can grow as your business requires without taking on too much too soon.

2. We’re passionate about Birmingham.

CM: There’s a lot to love about Bham Now.

First, sharing the resurgence of Birmingham with new food, new bars, new jobs…Amazon coming to town…there are so many positives happening right now in the Greater Birmingham area. Instead of focusing on negatives such as crime and politics, we focus on what’s up-lifting. This positive energy begets more positive energy.

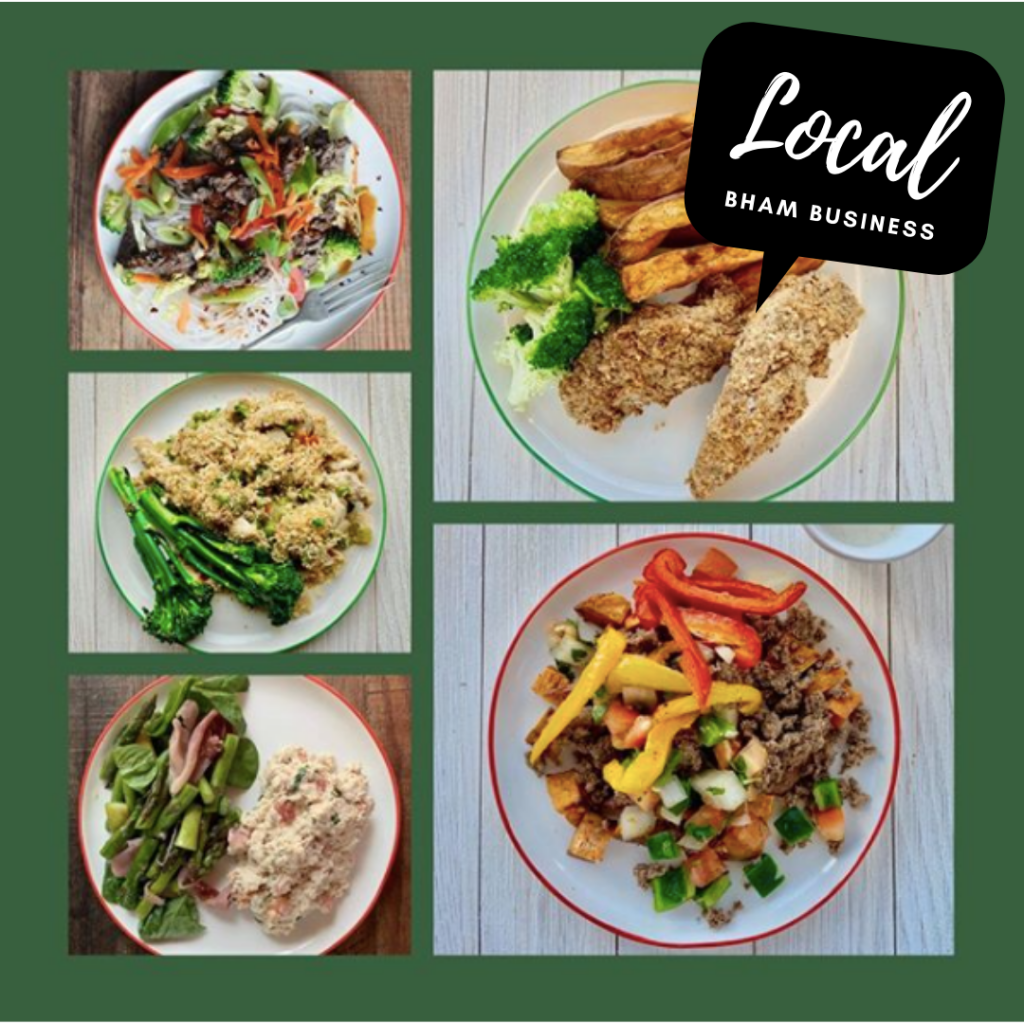

Second, supporting local businesses, being out and about and meeting so many business people in the Birmingham area—established as well as up-and-coming businesses. There’s a lot of joy from that and being able to provide a service they wouldn’t have otherwise. We’re locally owned and operated so we’re deeply invested in Birmingham’s success.

3. Bham Now is backed by a dynamic, creative and diverse team.

CM: I love working with our team. We have lots of young folks—watching them grow and having them be part of the development and growth of the company is rewarding from a career development standpoint.

Bham Now currently employs 19 people. Four work in business development and the rest are content producers, including writers, photographers and videographers.

4. Bham Now’s reach and growth are impressive.

CM: We reach over 30% of the Greater Birmingham market, which means more than 300k people in this market visit us every month. We have over 134k social followers.

The growth year over year has been tremendous, and we continue to look for talent to grow the team. We look for people who care about Birmingham and have a passion for media and creative excellence. A sense of humor helps too!

We have a unique business model. Part of the goal is to build a sustainable local media model and to create new jobs in Birmingham. So far it’s working.

5. Bham Now connects Birminghamians, businesses and organizations.

CM: Bham Now combines two constituents’ needs: the Greater Birmingham populace who wants to know what’s going on, what’s opening, how to get involved in local businesses and nonprofits, and the business community’s desire to share their story with fun, engaging content. We do all this in a way that reaches what we call “millennial-minded people.”

We have a pretty broad definition of “millennial-minded.” We’re referring to anyone who’s active, out and about and involved in Birmingham. We’re also thinking of the actual Millennial generation, which is poised to have the most spending power of any other group of people in the population across the country.

They’re also the future leaders, forming what Birmingham will be in the coming decades. While I’m not a millennial, I thought “why not partner with millennials who are up and coming and give them access to do it even better, with more knowledge, more resources and more info than we had.”

6. Our content provides value to Birmingham and to our clients.

Bham Now: One of the things you might not know about Bham Now is that we have a unique combo of about 30% “sponsored” and 70% “earned” media.

Sponsored media includes paid offerings where we work with clients to produce particular content campaigns for them. Earned means it’s not backed by a particular company. Here’s what Cindy had to say about these offerings:

CM: We’re continuing to expand Bham Now’s offerings to provide more value to the Birmingham population and to our clients. Examples include multimedia campaigns, with a full-time videographer (you can see him above, jumping into the rooftop pool at Forge). You can’t ever say you have it (marketing and media) with a checkmark. It’s a constant evolution and learning process, and I really enjoy that.

Our campaigns are more than an article—each Bham Now sponsored campaign is uniquely crafted for the client, backed by expert photography, videography and social media presence. Plus, it gets the secret “pepper sauce” of creativity from the Bham Now team.

There’s a lot of work across all of Bham Now’s distribution channels. We manage each of them uniquely to communicate with the audience in a way that’s meaningful to them. It’s different on LinkedIn, Twitter, Facebook, Instagram and in our newsletters.

Our 100% Google rating means that Bham Now’s content jumps right to the top when you search for something to do in Birmingham. It is also a benefit to our sponsors who see their content from Bham Now live through Google for a long time. And, 60% of our traffic comes from non-social media, which means it’s coming from Google, Apple News and directly to our site.

This is a really important point and distinguishes us from social influencers. In fact, one of our national clients came to us because the marketing software they use showed that Bham Now has the largest engagement across all channels plus the added benefit of search engine excellence.

Currently we have over 60 active clients on Bham Now, from local makers to large businesses like EBSCO to tourism companies like Gulf Coast Convention and Visitors’ Bureau.

Because of this range, we have offers that cover the gamut, from one-time social campaigns to multi-year media consulting and execution.

7. You can get involved with Bham Now, too.

Bham Now: Of course you can follow us on any or all of our channels: Facebook | Instagram | LinkedIn | Twitter | Newsletter. Hint: You gotta try our newsletter. It’s fun and includes puppies. 😉

Write to us with story leads, to ask about sponsorship opportunities, or to let us know you’d like to work with us at hello@bhamnow.com.

If it’s exciting for Bham, you’ll find it on Bham Now.

Forge News and Updates |

Our friends at Bham Now recently wrote this piece about Forge member Ryan Robinett with Multiply.

No matter what business you’re in, sales is part of it. That’s why you need to know Ryan Robinett, Principal and Founder of Birmingham-based Multiply.

A firm believer that “good salespeople are built, not born,” Robinett helps companies do more than they ever thought possible with the sales teams they have. Check out Multiply, or keep reading to find out more.

1. Who is Ryan Robinett?

Born and raised in Mountain Brook, where he and his wife are raising their two children, Ryan’s an Auburn grad with an MBA from UAB. After four and a half years at Accenture, he spent 12 years with Computer Technology Solutions (CTS).

When he joined in 2006, “CTS was a smallish IT professional services firm with one office in Birmingham.” He played a number of roles while helping to grow the company to a thriving regional firm.

Before long, Ryan was head of the Birmingham headquarters, then went to start and grow a new office in Chattanooga.

CTS’ success was noticed by CGI, a multibillion-dollar corporation based in Montreal, who bought them in 2017. At first, Ryan served as a VP operating in four states, but found he wasn’t enjoying his work as much as he wanted to.

So, he did what any good entrepreneurially-minded person does: he pivoted. This is where Multiply enters the story.

When Ryan asked himself what he most wanted to do next, he realized he wanted to help companies scale using the three-pronged approach that had worked for him at CTS.

“I boiled it down to three things that I really like—putting people in a position to be successful, equipping people to be successful and then seeing them achieve personal results which create corporate gains.”

Ryan Robinett, Principal of Multiply

2. What is Multiply?

Whether it’s helping a salesperson succeed, building a thriving team or helping existing sales teams, Multiply helps companies grow.

Helping companies scale

“Multiply is all about helping companies scale, which solves a universal problem.

I’ve helped companies that have eight employees, and I also work with some of the largest companies in Birmingham.

I assist them with organizational alignment as it relates to their messaging, their sales processes and the human capital management around preparing their sales team.”

Ryan Robinett, Principal of Multiply

Want to learn more? Visit Multiply at www.askmultiply.com.

Year 1 was a great one for Multiply, and there’s more ahead

Multiply’s had a great first year, serving Birmingham-based public utility companies, research institutions, financial institutions and more.

“I was part of a team that built a great services firm and formed Multiply based on the things I liked to do the most while scaling that company.

I look at 2019 as my first year for Multiply. I started in summer of 2018 and moved to Forge in December 2018. My first customers signed in January, which made for a great 1st year.”

Ryan Robinett, Principal of Multiply

Years 2+ promise to bring even more success: one thing to look for is the rollout of a tech solution that will sit in front of companies’ CRM (customer relationship management) software, that enables companies to better equip and manage their sales teams.

3. While Ryan Robinett’s a one-man show, he’s not alone.

While Ryan might consider adding employees someday, for now, he’s the only member of Multiply.

Because he works at Forge, though, he never has to work alone. Located at The Pizitz, Forge provides shared workspaces as well as office spaces for small businesses.

“When I was working in an office by myself, I couldn’t wait to hire people because I was lonely. Now I still work by myself, but Forge gives me the opportunity to have a coworker experience.

The other Forge workers and I share our day—the good things, the bad things. It checks the boxes of not just working alone, and you have people you develop camaraderie with and enjoy being around.”

Ryan Robinett, Principal of Multiply

Ryan likes that his Forge coworkers are all in different lines of work than he is, giving everyone the opportunity to learn new things and bounce ideas off of each other. Robinett also credits working in the shared space for increasing his productivity.

“There’s a motivation when you see people every day, and you want to tell them that your day is good,” Robinett said.

4. Ryan Robinett’s Birmingham-area favorites

We always love to ask people about their Birmingham-area faves, and Ryan didn’t disappoint with the top three things he and his family enjoy the most about the area.

Restaurant: Parish Seafood & Oyster House in Trussville

Haven’t heard of it? Ryan and his family like it that way. Parish’s is a dress-down kind of place where they’re not likely to run into the types of people who like to be seen out and about, and the seafood’s great.

Outdoor spot: Fishing two miles out on the Gulf of Mexico in a kayak

We realize this is a liberal interpretation of Birmingham-area, but we’ll go with it—because for some people, the beach is, in fact, an extension of their back yard, even if you have to drive a few hours to get there.

Ryan’s basically happiest when he’s out catching sharks or fish bigger than his kayak, and yes, he’s a fan of the Netflix series “Chasing Monsters.”

You can also catch him fishing at Lake Martin.

Local sports: all things UAB and The Birmingham Barons

As the incoming President of UAB’s Alumni Association, Ryan’s a fan of UAB sports, period. Well, that and Auburn football.

Also, he went to the first Barons game at the old stadium in Hoover, and the first one at Regions Field.

5. Have you ever thought about coworking?

If you’re currently trying to run your latest gig out of your recliner or your kitchen table, you may want to give coworking a try in 2020. It just might change your life.

Forge News and Updates |

We are thrilled that our Founder and CEO, Kim Lee, was nominated for the 2019 CEO Awards in the Rising Stars category by the Birmingham Business Journal. The BBJ asked Kim some questions about her journey as an entrepreneur- read on!

What’s the top factor that has allowed you to have a successful career?

“The people who have supported me along the way. Especially my family. There have been some very hard times along this journey, they have always lifted me up and reminded me of what the Lord has called me to do.”

What was the most pivotal moment in your career? What happened and how did you respond?

“Signing the lease for Forge at The Pizitz. Until then, Forge was still in idea stage. Once I signed the lease, the business instantly shifted from an idea to a real business. Every entrepreneur has this shift. It’s scary and exciting at the same time!”

What’s an interesting fact about you that most people don’t know?

“I have a master’s in counseling, I planned to work with juvenile delinquents. After graduation, unable to find a job in this field I started working for a window washing company in operations. This is where I realized my love for business as a service.”

What are you most proud of in your career?

“Creating a space and community where entrepreneurs and small business owners have a place where their business can grow and thrive. At Forge our day is made when one of our members tells us a story of how Forge has made a direct impact in their business.”

What is your biggest pet peeve?

“I really, really don’t like hearing people chew their food.”

What do you do outside of the office? What are your top hobbies?

“Our kids are at a great stage, they each have activities that they love. We have a basketball player, soccer player and dancer. One of my greatest joys is watching my kids do what they love. My hobbies are gardening, skiing and wake surfing.”

If you were CEO of Birmingham, what one change would you make to the metro area?

“I am excited about the new ride sharing program, Via. I would work to create more opportunities for public transportation. I would also continue to create incentives that make Birmingham an attractive place to locate your business.”

What’s your sales pitch for why someone should move to metro Birmingham?

“Top three things I love about Birmingham (besides the people) 1. Birmingham is beautiful! 2. Affordability for a city that is on the rise 3. Excellent schools. And then of course, there is the food!”