Forge News and Updates |

As we say goodbye to an exceptional year, it’s time to reflect on the milestones, connections, and moments that defined Forge in 2023. This past year has been a journey of growth, collaboration, and community at our coworking space. From the buzz of events that brought professionals together to the vibrant energy of our expanding membership, every day at Forge has been a testament to the thriving spirit of innovation and connection.

Join us as we highlight the events that left an impact- the growing number of members who call Forge home and the multitude of meeting rooms that buzzed with creativity and collaboration throughout 2023. Let’s celebrate the successes and set the stage for 2024.

We sent out a survey to Forge members to learn more about their experience at Forge in 2023. Here is some insightful information we learned from that survey!

Location, location, location! Forge is in the heart of downtown inside the historic Pizitz building. The Pizitz Food Hall offers plenty of lunch and dinner options for our members which is one big perk to our location!

Escaping the isolation of working from home and joining Forge provides entrepreneurs and remote workers a community they desperately need!

From startups growing to established businesses reaching new heights, the collaborative environment at Forge is proving to be the catalyst for success. This statistic is a testament to the power of community, innovation, and the opportunities that unfold at Forge!

Forge stands proud as 100% of our members affirm that their productivity has soared since joining our coworking community- a testament to the power of an environment designed for success.

A resounding 100% of Forge members attest to the power of networking within our community! Forge members say they’ve gained invaluable business connections since joining.

In 2023 Forge served…

92 Total Coworking Members

28 Private Office Members

2023 Booking Hours:

Meeting Room Hours: 1,526

Event hours: 250

Forge hosted over 30 events in 2023!

Over 1,090 tickets were reserved for these events!

Founder’s Friday with Jamie and Tez of Athetik

Founder’s Friday with Delphine Carter of Boulo Solutions

Forge’s Monthly Events:

Free Friday, Lunch & Learns, Founder’s Friday & Connect Networking Breakfast

A Lunch & Learn with KaLyn Williams

Forge also hosted numerous events specifically for our members- anything from happy hours to breakfasts, New Member Lunches, holiday themed parties and much more!

Holiday Mix-er Event at Christmas, we learned how to make two holiday cocktails!

Spirit Week filled with fun dress up days

From the excitement of events that illuminated our shared spaces to the hum of productivity resonating in every corner, each day at Forge has been a canvas painted with the vibrancy of connection and growth. As we step into the promising pages of the new year, we carry with us the triumphs of 2023.

To every member, attendee, and participant who contributed to the Forge narrative, thank you for making 2023 a year to remember. Here’s to the shared stories, the possibilities and the boundless horizons that await in 2024. Happy New Year, and let’s continue to forge success together!

Forge News and Updates |

As the winter chill embraces our community at Forge, December arrives with a flourish of festivities. Get ready to unwrap a month filled with events that celebrate the spirit of the season.

#1: Holiday Mix-er Event on December 6

Jingle, Mingle and Mix! Join us for a holiday workshop and learn how to make two tasty holiday cocktails with Diego Lopez from The Louis Bar– one of these cocktails will be an espresso martini with Honest Coffee.

This event is free for Forge members and open to the public- $20 for nonmembers. Forge Members can use the code ForgeMember when registering on Eventbrite. Join us to get into the holiday spirit! RSVP here.

#2: 10 Days of Giveaways on Forge’s Instagram

Every year Forge collaborates with local businesses to post giveaways leading up to Christmas! Check out our sponsors for this year: Unos Tacos, The Louis, Asthetik, x4 Fitness, Cala Coffee, House Plant Collective, Sidewalk Film Center and Cinema, Thirstea, Ashley Mac’s Kitchen. Be sure to pay attention to Forge’s Instagram posts December 4-15 for a chance to win some awesome prizes.

#3: Community Giveback Supporting STREAM Innovations

Forge is partnering with

STREAM Innovations in the month of December. Over the years, STREAM Innovations has hosted Lego Build Challenges and given away Lego sets to foster imagination and creativity for young innovators across Birmingham. We have identified a number of students that have never played with Legos or didn’t have access to Legos at home.

We need your help this holiday season by donating new and used Legos to STREAM Innovations to inspire the next generation of engineers, artists, and creatives. STREAM plans to use your Lego donations in 2024 for STREAM Lego giveaways and STREAM programming across Birmingham.

#4: Forge’s Holiday Sale

Unwrap the gift of productivity this holiday season! Enjoy 50% off your first two months with Forge’s Coworking Membership. Elevate your workdays with 24/7 access, exclusive events, and more. It’s the season of savings and success!

From the clinking of glasses at our Holiday Mixer to the anticipation of our ’10 Days of Giveaways’ showcasing local businesses on Instagram, and the warmth of our community giveback event collecting Legos for STREAM Innovations, December at Forge will be full of connections, celebrations, and acts of kindness.

Join us as we usher in the most wonderful time of the year within the walls of our shared workspace. Let the festivities begin!

Forge News and Updates |

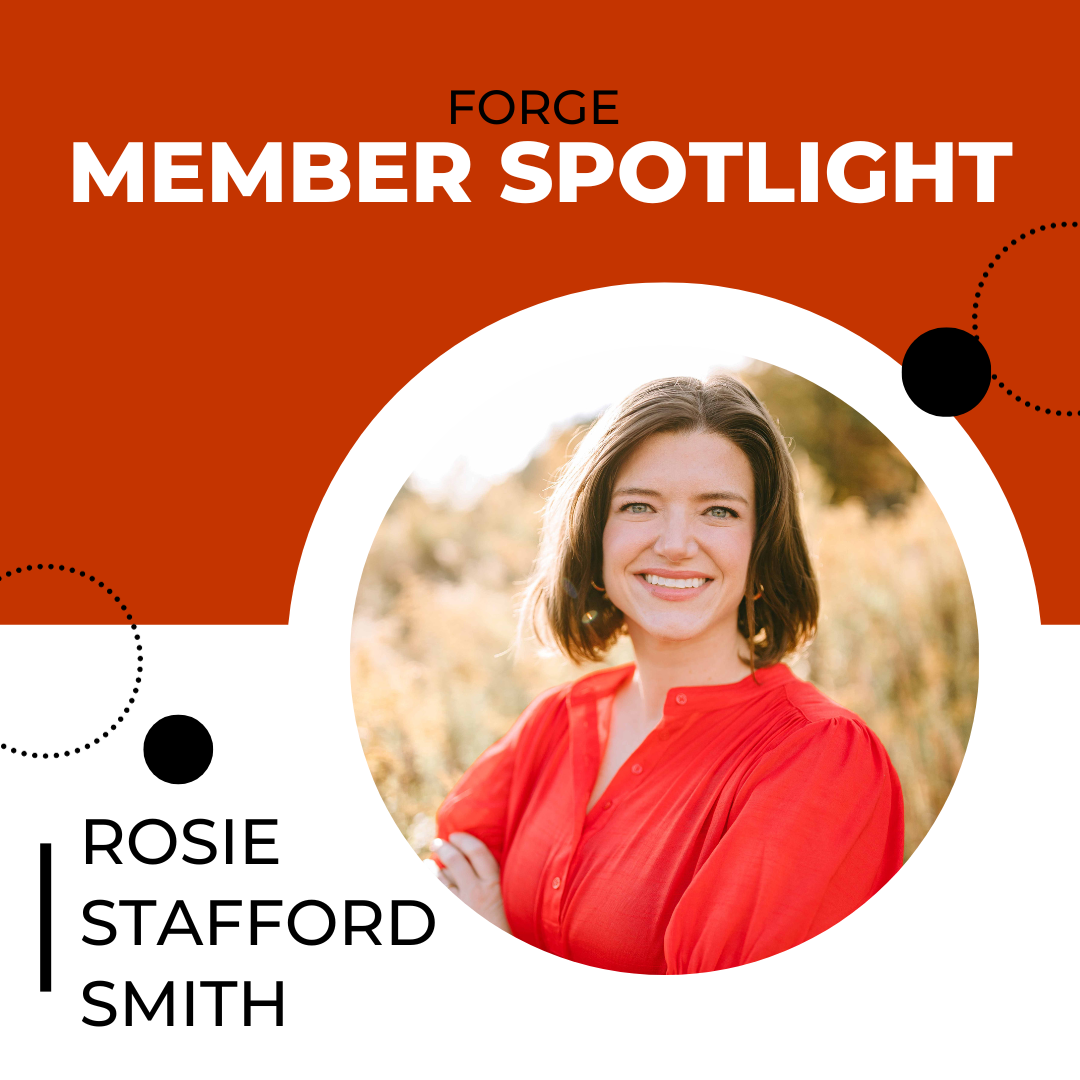

Forge is happy to welcome Rosie Stafford Smith! She is the Founder, Principal Consultant of the Stafford Smith Group.

In addition to your job title, tell us a little bit about what you do/your company does.

We help busy social impact leaders turn their big ideas into feasible, funded strategies.

Most often that looks like working around the US with 1) nonprofits and their boards on strategic planning, 2) donors to invest their philanthropic dollars, or 3) companies to design and/or execute community programs aligned to their values.

The heart of what we do is helping resources–ideas, funding, strategy–connect with the people and places it can have the greatest impact.

What is your favorite part about your job?

The creativity of continuing to reinvent ourselves; we are always learning what works–and doesn’t. It’s energizing not to feel stuck but to feel like there’s a puzzle we’re continuing to solve for ourselves and our clients.

What made you decide to join Forge?

Our team is growing, and we were looking for a place to gather and collaborate in person without being in the middle of a coffee shop or library.Our team is growing, and we were looking for a place to gather and collaborate in person without being in the middle of a coffee shop or library.

What is your favorite thing about Forge?

The location and natural light–love being close to so many of our clients and not feel like we’re in some soulless building.

What is your favorite spot/place to work at Forge?

Our office or the communal space with the white board.

What are your favorite tech tools to get your job done or keep your life organized?

Loom for sharing processes/feedback with the team.

Is there a product you cannot live without?

My airpods

What is the last show you binge-watched?

Lupin

What is your ideal weekend in Birmingham?

Delicious coffee from June and breakfast at Lady Bird tacos, time at Red Mountain park hiking with my family or a workout at X4, reading a book on my porch, grabbing a cocktail with friends at Juniper, home in bed by 9:30pm.

Forge News and Updates |

In the heart of Forge’s collaborative workspace, ideas are evolving, and businesses are flourishing. We want to shine a spotlight on five exceptional members who are leading the charge with their exciting ventures. From tech startups to creative agencies, our diverse community is a hotbed of talent and innovation, and these entrepreneurs exemplify the spirit of success that permeates our coworking space. Join us as we take a closer look at the stories of these remarkable individuals and their businesses, and discover how Forge serves as the launchpad for their inspiring journeys.

Vero Skills

The aim of Vero Skills is to train disadvantaged individuals in values-driven corporations’ unique entry-level qualifications to resolve the tech talent deficit facing America. Vero Skills provides underserved students access to on-demand training and mentoring by top industry professional software developers who work for the biggest companies in the world.

By working with their community partners, Vero Skills aims to help every student overcome the barriers they face and achieve their goals of entering the tech industry.

Project EMS

Project EMS motivates and supports under-resourced students from multiple socioeconomic demographics on their journey towards a successful academic education. Project EMS, Inc. is a 501(c)(3) tax-deductible nonprofit organization that believes they can create a future in which every student will have equal access to educational resources and opportunities.

Project EMS hosts a STEAM Camp in the summer! (STEAM represents STEM plus the arts – humanities, language arts, dance, drama, music, visual arts, design and new media.) Project EMS, Inc. proudly hosted their Second Annual STEAM Camp, immersing students in an exhilarating week of hands-on learning. From suturing and dissections to 3D printing, rollercoaster dynamics, and drones, the campers had an incredible experience!

Golightly Landscape Architecture

John Wilson of Golightly Landscape Architecture has been a member at Forge from the very beginning! From tidy courtyard gardens and exterior renovations to master plans for new construction and estates, Golightly Landscape Architecture provides comprehensive and site-specific designs that draw their clients into the garden.

From master plans for new construction and estates to courtyard gardens and exterior renovations, Golightly Landscape Architecture has designed more than 80 residential gardens in Birmingham and beyond. Check out some of their work here.

Stafford Smith Group

The Stafford Smith Group prides themselves on helping busy social impact leaders get their ideas out of their heads and into the world. Rosie Stafford Smith has a knack for simplifying complexity and she has a lifelong commitment to social justice. Rosie works with a variety of leading families, nonprofits and companies across the United States.

The Stafford Smith Group has worked with clients like Jones Valley Teaching Farm, Protective Life and United Way. They most often are hired for strategic planning, philanthropy advising and strategy coaching.

AMZ Atlas

At AMZ Atlas they have a depth of knowledge and singular focus on Amazon that allows them to create more value for their clients- clients who are in desperate need of hyper-focused Amazon services.

The AMZ Atlas team is made up of strategists and tacticians, from former brand managers with hard-earned Amazon success, to specialists who live and breathe the world of Amazon commerce, and veterans in areas like retail pricing, inventory, brand protection, and operational experts who thrive on efficiency.

At Forge, innovation and collaboration thrive, and the stories of these remarkable businesses serve as a testament to our community. From empowering underserved students through tech training to inspiring the next generation of scholars with STEAM education, and from crafting beautiful landscapes to catalyzing social impact, these entrepreneurs are not just building businesses; they’re shaping a better future.

As we continue to grow together within our collaborative workspace, we’re inspired by our Forge members. We can’t wait to see what the future holds for them and all the other incredible members who make our coworking space a hub of innovation and success.